Webot provides customers with the ability to easily access and download their tax report so they may better prepare for tax season. This article answers basic questions about tax reports and where to access them on the Webot mobile and desktop platforms.

You can follow these steps to download your tax report on Webot.

*Note: The tax report includes four documents: Form 8949, Capital Gains & Income, Transaction History, and the Webot Tax Report Disclaimer.

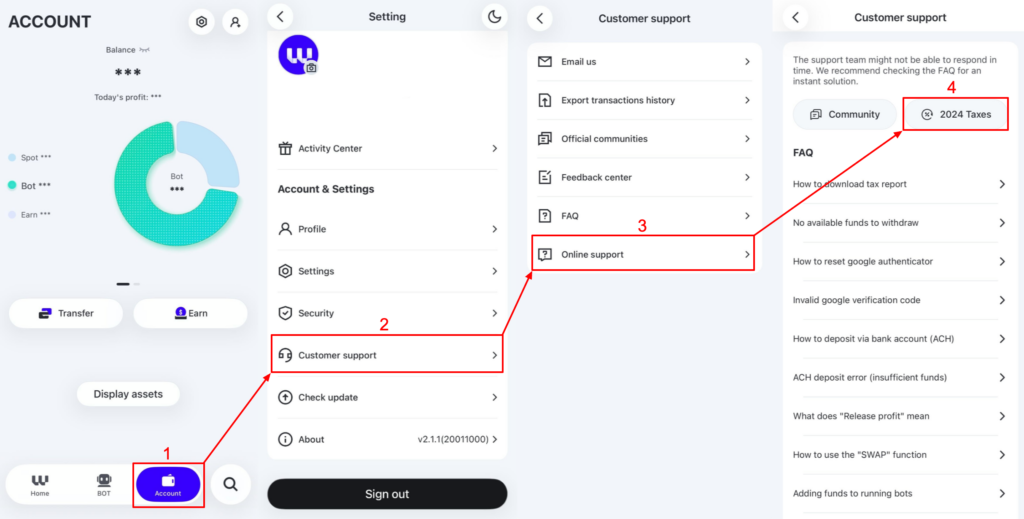

On the mobile app

1. After logging in, click on [Account], then the [Settings Icon], followed by [Customer Support], then select [Online Support], and finally [2024 Taxes].

2. Then, click on [Download my tax report], choose your preferred calculation method, and finally click on [Send].

3. The tax report ZIP file will be generated within a minute, and you will receive an email. Click on [Download] to download the tax report ZIP file to your local device.

On the website

1. Log in to your Webot account and click the [Support] on the top, then choose [Taxes].

2. Select the “Calculation methods” you want, and click [Download].

3. The tax report ZIP file will be automatically generated within five seconds and downloaded to your local device.